An inclusive

mobile payments app

made simple for MFIs

with MicroPay

Philippines’ newest partner for MFIs and clients nationwide that delivers advanced financial solutions through a mobile payment app.

Experience

Banking & PaymentsUsing Open Digital Networks

Breaking the barrier of high infrastructure costs, expensive software licenses and switch-based teller machines to promote more financial and digital inclusion.

An inclusive

mobile payments app

made simple for MFIs

with MicroPay

Philippines’ newest partner for MFIs and clients nationwide that delivers advanced financial solutions through a mobile payment app.

Experience

Banking & PaymentsUsing Open Digital Networks

Breaking the barrier of high infrastructure costs, expensive software licenses and switch-based teller machines to promote more financial and digital inclusion.

Unmatched Flexibility

Banking & Payments Using Open Digital Networks

Micropay allows app users to apply and pay for affordable loans from microfinance institutions.

Unmatched Flexibility

Banking & Payments Using Open Digital Networks

Micropay allows app users to apply and pay for affordable loans from microfinance institutions.

Meet your new

ALL-IN-ONE

financial companion

TRANSACT

Withdraw, receive, and send cash to other banks or e-wallets instantly via QR through the Micropay app.

PAY BILLS

Get access to 300+ billers and directly pay your bills from the app.

SCAN TO PAY

Micropay offers a secure, smooth, and enjoyable shopping and pay-bills experience for users with the app’s scan-to-pay feature.

PERSONALIZED

Micropay members get a personalized phygital QRph card. Users can easily make transactions with their personal, easy-to-scan cards.

EASY MEMBERSHIP

Sign up and become a Micropay user within minutes.

ECOMMERCE CHANNELS

Developed for MFIs and entrepreneurs in the micro, small, and medium-scale sectors.

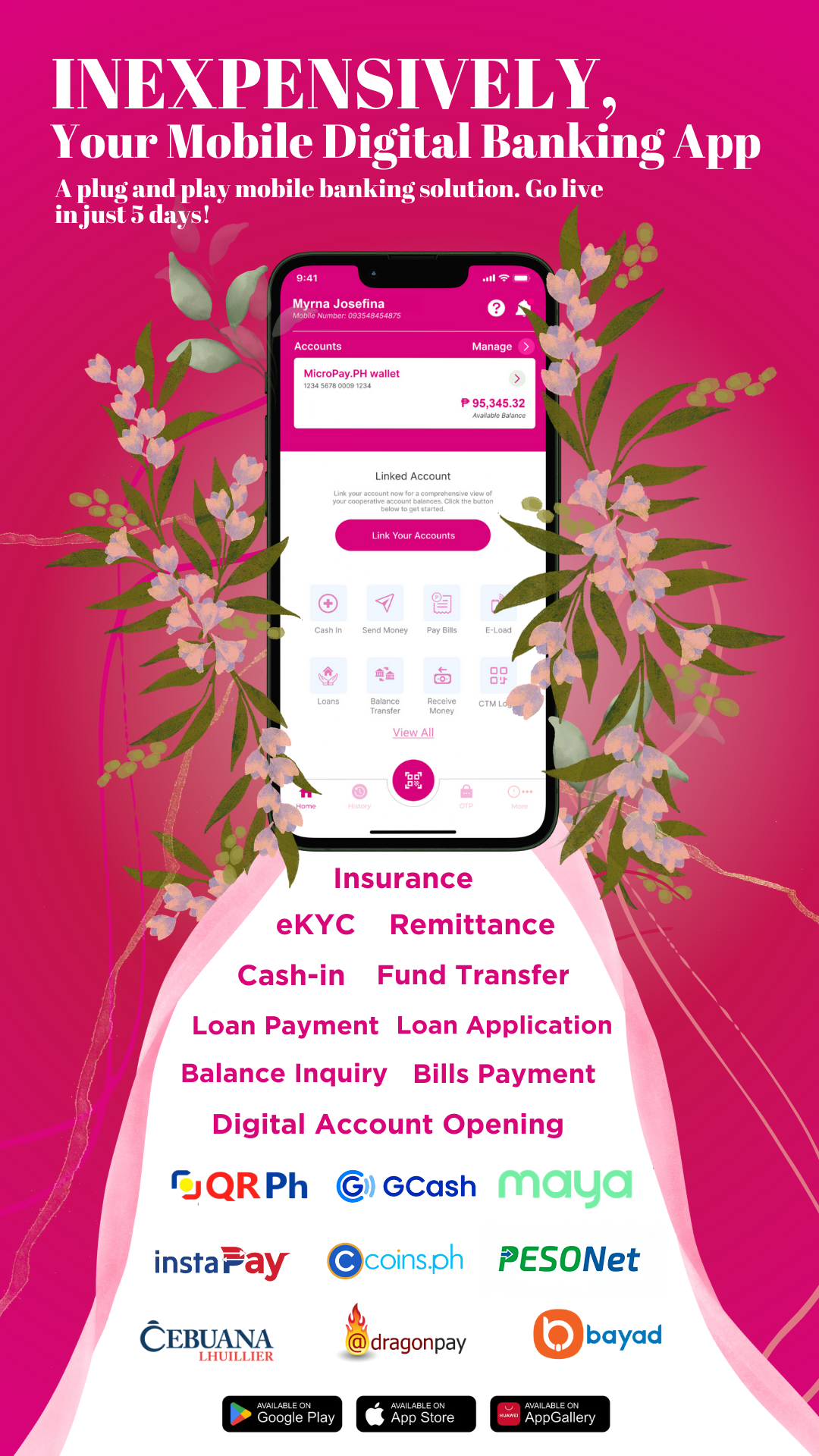

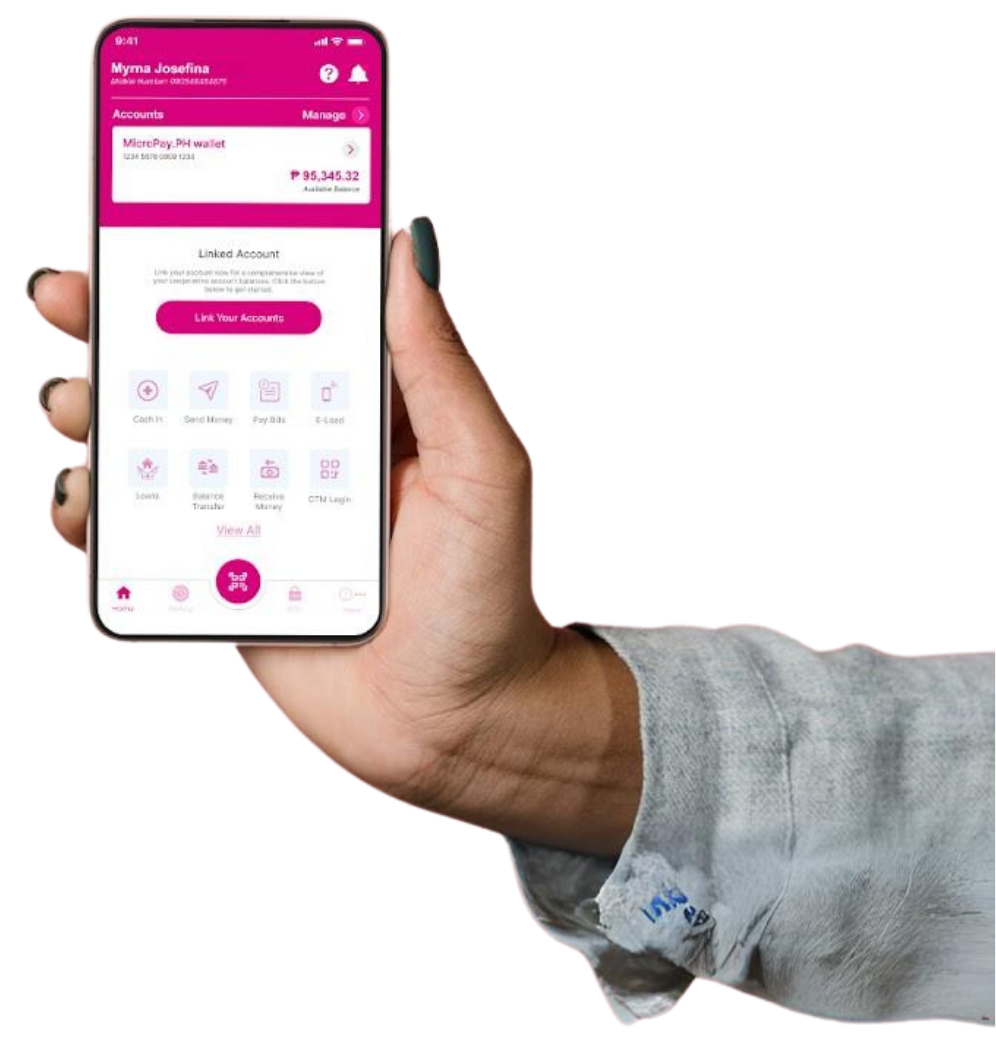

What We Offer

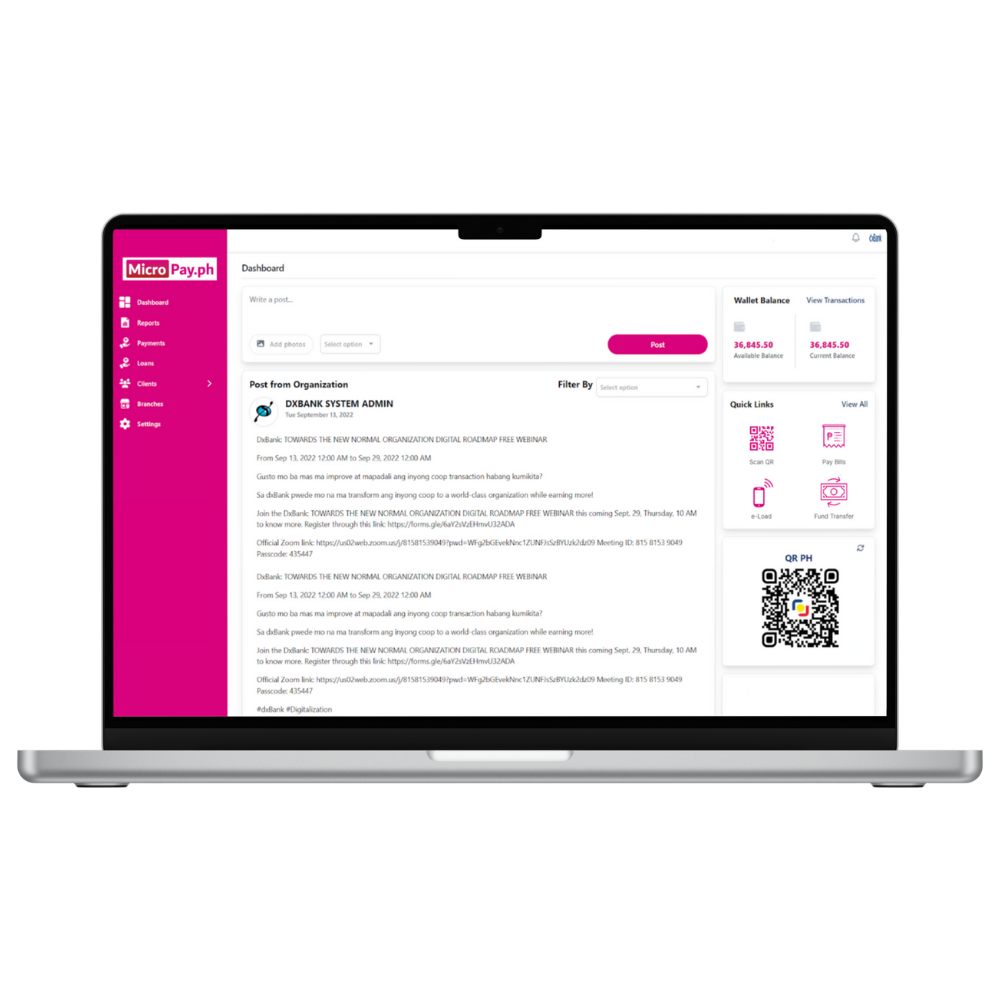

A Mobile Wallet with Banking Features

Manage your accounts remotely with MicroPay’s online mobile app. Monitor your balance, transfer funds, and settle bills effortlessly, all from the comfort of your computer or mobile device.

Micropay Branch Portal

Connecting microfinance institutions in the Philippines through our Web portal. Accept remittance cash pick up service, do fund transfer to any bank, pay bills, do bulk disbursement and even approve loans from MicroPay Mobile App.

ATM Cards, Reinvented

Experience the future of banking with MicroPay’s innovative Phygital QR Cards. Transfer funds to your MicroPay wallet even without a smartphone and access our CTM for cash in and out transactions just by easily scanning this card.

Switch-less, QRPH-enabled

Cash Teller Machine

Extend digital banking experience using the most innovative Cash Teller Machine or CTM. Load cash or disburse cash from your wallet anytime. Use any QRPh-enabled mobile banking app to withdraw funds from your bank of choice.

Get your own QRPh, NOW!

Accept payments from your users with MicroPay’s Scan-to-Pay feature from all participating banks, e-wallets, and other finance companies.

Access your MicroPay portal to accept payments and remittance for FREE!

Whatever your Accounting or Core Banking System (CBS) is,

we got you! MicroPay App is CBS-agnostic!

How To Onboard And Provide

Digital MFI Services

Portal Sign Up

Get instant access to our DxBank Web Portal and start your branch banking transaction to manage requests and transactions of your customers made from their mobile app, MicroPay.

Ask Customers to Download MicroPay

Stay connected with us on social media for sneak peeks, behind-the-scenes looks, and more. Follow us on all our platforms today!

Own Cash Teller Machines in Easy Lease-To-Own Model

Whether outright purchase or our light lease-to-own (up to 5 years), own and operate the most innovative Cash Teller Machines. Earn huge rebates from transactions your customers (and non-customers) make.

Issue "Phygital" QR Cards

Either we do it for you or you use our Onboarding Tool to issue cards to your customers with smart phone device challenges.

Grow!

As your bank systems mature, we can introduce more services to your Mobile App to include Digital Account Opening so you can get more customers anywhere in the country! Growth is now digital!

OTHER DIGITAL TOOLS AVAILABLE

eKYC Integration

eKYC Integration

Digital identity verification empowers businesses to enhance security, streamline onboarding, and decrease expenses, creating a better experience for your customers.

Loan Disbursement Options

Loan Disbursement Options

Via QRPh Card - With QRPh-enabled cards, your customers receive their loan funds in a secure and streamlined manner.

Via Cash Teller Machines - Loan funds of your customers are always easy and accessible to cash out through QRPh-enabled CTMs.

Via POS Devices - For your business, the POS provides an easier way to disburse loans and accelerate the overall process.

Via Mobile eWallet - Your customers are in control of their loan management with the MicroPay eWallet.

Loan AI Technology

Loan AI Technology

AI-powered loan technology incorporating selfie eKYC verification, streamlines loan assessments, minimizes manual intervention, and facilitates swift, accurate, and trouble-free loan approvals for your customers.

Why switch to Micropay?

- Better client satisfaction of performing banking transactions anytime, anywhere.

- Reduces source of errors at a low cost.

- Markets to the microfinance institution and eliminates manual processes in customer onboarding.

- Allows microfinance Institutions to participate in wider ecosystems through partnerships.

LATEST NEWS

Traxion Pay, Coins.ph collaborate for improved remittance services for OFWs

Financial technology (fintech) firms Traxion Pay and Coins.ph have partnered up to "simplify" remittance transactions for Filipinos abroad. The two firms recently announced their blockchain-enabled remittance (BER) solution that will allow for cryptocurrency conversion into Philippine Pesos (PHP) to benefit Overseas Filipino Workers (OFWs).

Traxion and United Aurora Lending Corporation (UALC) Partner to Expand Digital Financial Services in Zamboanga del Sur

Ortigas, Pasig City – Traxion, a leading fintech innovator, has partnered with United Aurora Lending Corporation (UALC), a lending and insurance company, to enhance financial accessibility in Zamboanga del Sur. This collaboration introduces cutting-edge digital financial services to the province, providing residents with greater access to secure, convenient, and affordable financial solutions.

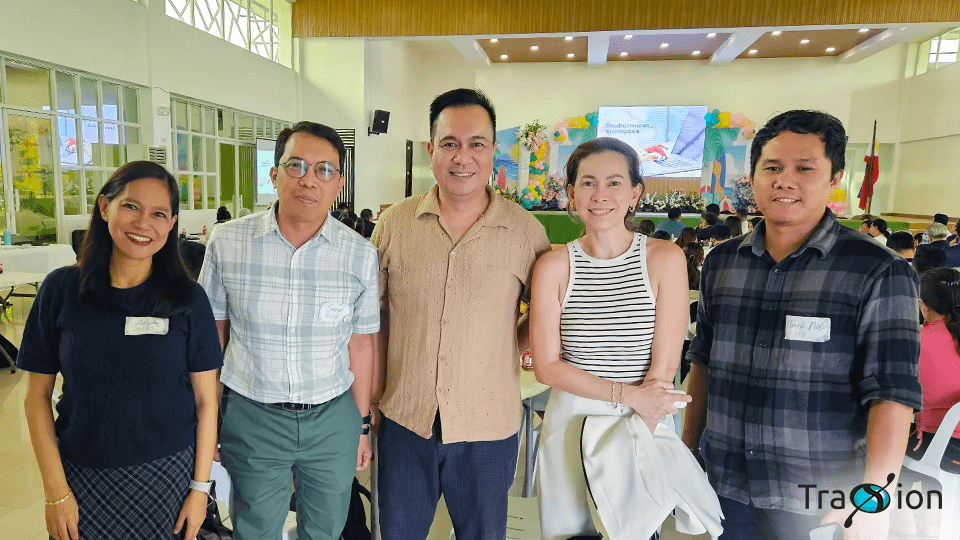

Traxion Empowers Mindanao Microfinance Institutions with Digital Innovations at MMC 2025

Traxion is honored to be a key sponsor of the Mindanao Microfinance Conference (MMC) 2025, held in the stunning Siargao Cultural Convention Center, March 20-21, 2025. With the theme 'Navigating Uncertainty: Building Resilient Microfinance Institutions in Mindanao,' the conference addressed critical challenges and opportunities to the businesses.

CONTACT US

Better yet, see us in person!

We love our customers, so feel free to visit during normal business hours.

Traxion Tech Inc.

10th Floor, Taipan Place, Garnet Rd, Ortigas Center, Pasig City

E-Wallet Services Powered by Traxion Pay Inc., Supervised by Bangko Sentral ng Pilipinas

Copyright © 2025 MicroPay – All Rights Reserved.